Industry Toolkit

Youth Travel Toolkit Section 4: Scotland, Glasgow & Loch Lomond

Sections

- Youth Travel to Scotland

- Glasgow's Student Population

- Youth Travel to the Loch Lomond Area

What do we know about the potential for youth travellers and visitors to Scotland, Glasgow & the Loch Lomond area?

1. Youth Travel to Scotland

The Millennial Market in Scotland (2015)

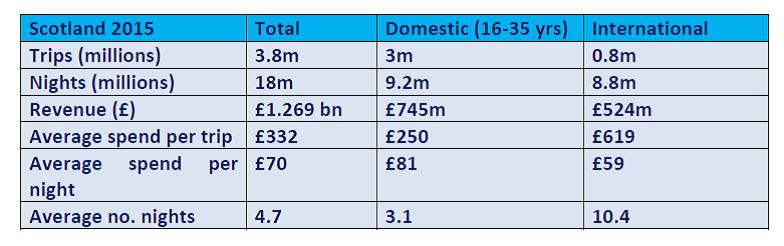

In 2015, the Millennial market generated 3.8 million trips, 18 million nights and £1.269bn in Scotland. Millennials spent an average £332 per trip, £70 per night, and stayed in Scotland for 4.7 nights (GBTS, IPS).

Domestic Millennial visitors (aged 16-35) to Scotland generated 3 million trips, 9.2 million nights and £745 million in expenditure in 2015. On average, the domestic Millennial visitors spent £250 per trip, £81 per night, and stayed in Scotland for 3.1 nights in 2015 (GBTS).

• Overseas Millennial visitors to Scotland generated 0.8 million trips, 8.8 million nights and £524 million in expenditure in 2015. On average, the overseas Millennials spent £619 per trip, £59 per night, and stayed in Scotland for 10.4 nights in 2015 (IPS).

Over one third of Millennial visitors to Scotland used social media to plan their holidays here and they also have higher propensity to use social media as information sources while travelling.

*Source: VisitScotland 2015.

Header and thumbnail photographs by Peter Dibdin,VisitScotland. Footer image: Paul Saunders.

Top Tip

Millennials are much more likely to seek special deals and respond opportunistically to low prices and interesting packages - can you create packages to attract them?Further information and resources

Read the VisitScotland Report on Millennial Travellers to get ideas on how to attract them.

2. Glasgow's Student Population

Young people often attract others to a destination

Scotland's towns and cities are popular destinations for students from other parts of the UK and overseas, and in turn, this vibrant sector contributes to the economy as a workforce, while also attracting visiting friends and relatives.

The Value of Students to the UK Economy

UK international students are estimated to generate around £17.5 billion for the UK economy, and support almost 22,000 full time equivalent jobs outside higher education. Around £4.5 billion is spent directly with universities themselves. The education market is expected to grow in future, with the British Council estimating that the total number of students enrolling in higher education worldwide, including those studying in their home country, will increase by 21 million between 2011 and 2020 from 178 million to 199 million- with continued growth in emerging markets (HM Government, 2013)

Glasgow's Student Population

Glasgow's Tourism and Visitor Plan to 2023 recognises both study and visiting friends and relatives as two key target markets for development. Glasgow has the second-largest number of higher education students (undergraduate and postgraduate) in the UK compared to other major university cities with nearly 67,000 higher education students and more than 66,000 further education students (HESA, SFC).

The city's five colleges and five higher education institutions attract more than 133,000 students from 135 different countries. Glasgow’s higher and further education sector is highly international, attracting students and staff from across the UK, Europe and the world with 15,000 foreign students. This vibrant, highly educated group is significant not only to the city's economic growth but to its tourism development potential.

Interface and the West of Scotland Knowledge Transfer Partnership and similar projects aimed at bringing academic research to market/commercializing are also at the heart of Glasgow's innovation and economic growth plans.

Glasgow as a Gateway to Other Destinations

Given the close proximity between Glasgow and the Loch Lomond area, and easy access to the Clyde Sea Lochs, Argyll and further afield into the Highlands, it makes perfect business sense for tourism and hospitality industry sectors to work together on engaging and attracting youth travellers. Consumer campaigns such as Pack More In and Wild About Argyll are just two good examples of destinations working together to attract new customers and visitors, and amongst them, younger ones which fit the youth traveller profiles.

Top Tip

The Pack More In consumer campaign, bringing together Love Loch Lomond, People Make Glasgow and Scotrail to highlight the best of both Glasgow and Loch Lomond and to join up travel experiences in order to create new customers is a good example of how organisations can collaborate to reach new markets.Further information and resources

Find more information on Glasgow Further & Higher Education

Read Glasgow's Tourism & Visitor Plan

Read the case study on the Pack More In Campaign.

3. Youth Travel to the Loch Lomond Area

A recent survey of young people aged 18-34, many of whom were full-time international students based in Glasgow, found that:

- The Loch Lomond area has to compete with other destinations, particularly cities, such as Edinburgh, Glasgow, St. Andrews, York, Manchester, Liverpool

- Festivals and events are the preferred motivations for younger travellers

- More than 50% of respondents preferred to stay 2 days average –this was the length of stay

- Lone travellers (independent travellers) spent more than 1 month, often to learn about their heritage.

- The preferred time of year is Spring and Summer for travel

- Authenticity was the highest rated motivational factor for travel

- Twitter and Instagram users actively seek out Word of Mouth recommendations

- Key motivations of youth travellers were to escape pressure and also adventure-seeking

- Reducing pressure from daily life is the second motivation to travel after authenticity

- Local food is an important decision when considering a trip

- When travelling for nature and views, outdoor pursuits are also important, eg walking, hiking.

- Survey respondents seek a “local experience” specific to the area they are visiting

- Key sources of travel information are e word of mouth and Internet search

- Overall perceptions of Loch Lomond are positive – nature, scenery, peaceful mentioned during the interview.

- Visuals are also highly important. Themes: nature, outdoor, activity.

- Travellers are seeking authentic experiences across culture, heritage, outdoors and good food.

- Younger travellers usedTripAdvisor forums and searches on Twitter and Instagram for trip decision-making.

Based on a survey sample of 150 respondents aged 18-34, 8% from the UK, 92% international.

Top Tip

Twitter and Instagram users actively seek word of mouth recommendations for travel experiences. If your business is active on these channels, is your content attracting and engaging these travellers?Further information and resources

Check out Digital Tourism Scotland for workshops to help you with social media, and online guides in the topic library.

More Inspiration

-

Watch the VisitScotland "Come Along" video targetting young romantic Millennials.